Article by Isabel Chew-Lau, an associate of OTP Law Corporation

Introduction

The COVID-19 situation has placed Singapore in a dire crisis. It is not just a healthcare crisis. It is an economic crisis that threatens to shut down businesses and in turn the livelihood of thousands of Singaporeans. It is a crisis that Singapore’s leaders have named as “the most serious crisis this country has faced since independence”. Left unchecked, this crisis will no doubt affect cashflows of both businesses and individuals.

In anticipation of the economic fallout, the government has sought to introduce a suite of measures. Among these measures is the introduction of the COVID-19 (Temporary Measures) Act 2020 (“the Act”). As the name suggests, this Act aims to provide temporary relief to some business and individuals who, because of COVID-19, cannot fulfil obligations under contracts that they entered into at a time when the current situation was completely unforeseeable. In doing so, it seeks to balance the sanctity of contract with intervention to safeguard Singapore’s economic structure.

As a business owner or individual who needs to postpone your contractual obligations because of COVID-19 (or are faced with a party who does), you will want to be familiar with whether and how the Act operates.

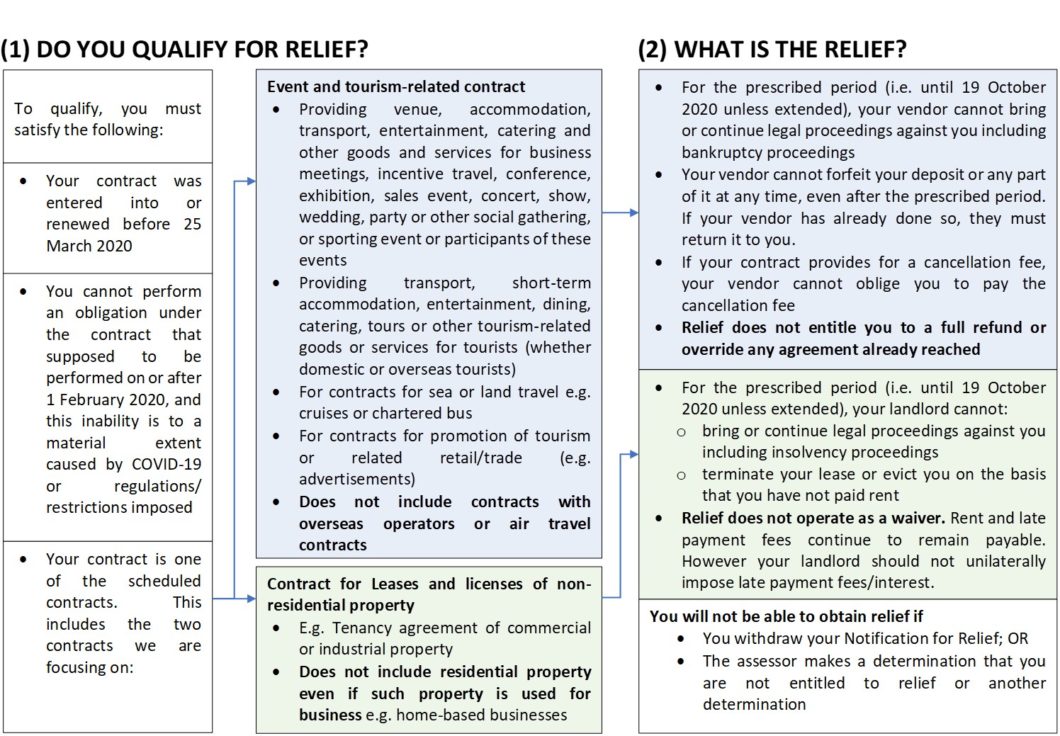

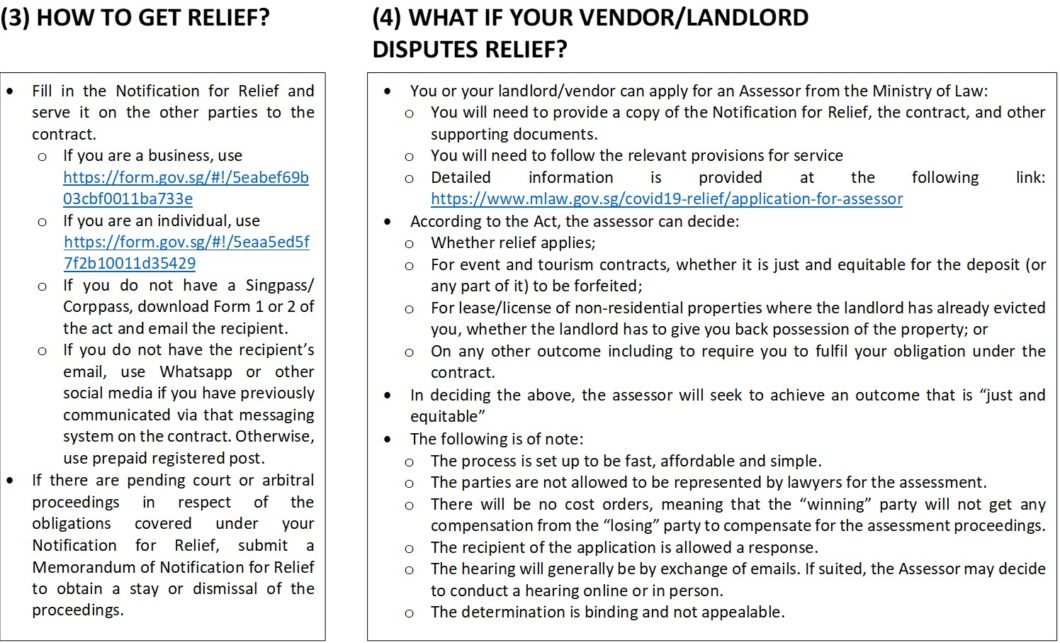

Below, we focus on two types on contracts that the Act applies to: Event and tourism-related contracts and leases and licenses of non-residential property. We summarise our understanding of the Act and provide a practical tip on how to navigate the uncertainties that you will inevitably face.

Mapping out the application of the Act

A practical tip – Negotiate!

Having looked through the above, there will likely still be many difficulties you encounter, like:

- You still don’t know if your case qualifies for relief.

- You think your case does not qualify for relief e.g. the performance of your obligation is after the prescribed period, but you have been impacted by the COVID-19 situation and want to ask for relief regardless.

- You want relief that the Act may not provide for e.g. a full refund or postponement.

- Your vendor has given you some options that you do not prefer e.g. postponement until early next year.

- You want to preserve your relationship with the other party.

- As a vendor/landlord, you are yourself suffering from the COVID-19 fallout and cannot afford to provide relief.

- You don’t want to go through the hassle of going through the assessment process.

- You don’t know how the assessor will decide if you go through the assessment process; the outcome may not be favourable to you.

There is good news. That is, that the other party will encounter the same difficulties as you.

It is for this reason that we want to emphasize negotiation and compromise with the other party. Such negotiations can and should take place even before you serve a Notification for Relief; just be aware that you must be prepared to uphold your offer.

In preparing for these negotiations, and familiarizing yourself with the Act, we encourage you to ask yourself:

- How has COVID-19 affected my ability to perform the contract?

- How has COVID-19 affected the other party?

- What can I offer to the other party as a compromise? Some possible areas you can consider putting up for discussion are:

- If you will like a refund of your deposit, to forfeit some part of your deposit to compensate your vendor for work already put in.

- To tell your vendor early if you want to terminate the contract, so that your vendor has a chance to find another party to fill in.

- To find other willing parties to take up your part of the contract e.g. hold the event on your date.

- If it is a postponement, the period of postponement and the rates applicable (be it 2021 rates or even a discount of the rate initially agreed), or other “perks”.

- A temporary reduction of your rent.

- A reduction or waiver of the late payment fees.

- An instalment plan (even past the prescribed period) to allow you more time to make payment.

- How can you both deal with the present situation keeping in mind the long term?

The bottom-line is this: the Act gives you a breather to overcome the current cash-flows you are facing. However, you should not rush to get your case assessed. There is a good chance that you can reach a mutually acceptable agreement with the other party, if you take the time to explain your situation and empathize with theirs.