Financial Manipulations In Matrimonial Cases – A Lawyer’s Perspective By Susan Tay

This was a presentation made by Ms Susan Tay at the ‘Seminar on Financial Manipulation in Matrimonial Cases” organised jointly by PracticeForte Pte Ltd and The Law Society of Singapore and held on 27 April 2017.

Introduction:

Thank you

Hello everyone, my name is Susan Tay. 1stly and most importantly, I, on behalf of PracticeForte Advisory, will like to thank all of you for coming to our inaugural seminar organised by PracticeForte.

I will also like to thank the Law Society of Singapore for agreeing to co-organise it with us. It is all due to the reach of the Law Society that we can draw such a large audience today. Some of us have never spoken before 100 people and second to appearing before the CA, this is probably my most daunting “speech” ever. Thank goodness, my segment is only for 5 minutes and hopefully already 1 minute has passed.

Overwhelming Sign-Ups

But I knew the topic “financial manipulations in matrimonial cases” will be of particular interests to lawyers, not just family lawyers really but anyone of us who are interested in how these manipulations happen. True enough, I was told that within the 1st hour after the Law Society advertised the sign-up for this seminar, all the slots were taken. There are 131 of you here and some more who have asked me if they could crash this seminar.

Lawyer’s Perspective

My 5 minute segment is really to speak from a lawyer’s perspective. Why do I use forensics accountants in my cases? When do I call them in? How do I decide at what point I should advise the client to continue investigations or when we should stop?

How It Began- Ong Tay & Partners

Let me begin by telling you how it all began for us. My firm started working with Yew Fai, our affiliate forensic accountant sometime in 2000. Back then, we were Ong Tay & Partners, 3 lawyers and our office was at Circular Road. There was a corner coffee shop where we went, bought Mr. Wan a cup of coffee and then picked his brains over accounting. I don’t know how, since I came from the commerce stream in JC and I have a CPA in my family – Shirley Tay, the other forensic accountant, is my sister, but I managed to fail Basic Accounting in Practice Law Course.

Mrs Lim’s Case

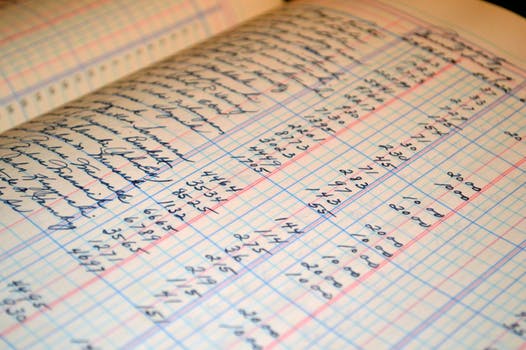

Anyhow, Yew Fai’s 1st foray into forensic accounting is a “matrimonial case”. It happened around 2001. I say “matrimonial” (in inverted commas) because the divorce was actually handled by Mr. Goh Aik Chew who had just won Yow Mee Lan v Chen Kai Buan. That time, 3 of us at Ong Tay & Partners were busy starting a dot.com so we referred our client, Mrs Lim, to Aik Chew. Even back then, as small law firms, we saw the importance of collaborating with other firms and thought Aik Chew a good lawyer to refer this case to. Mrs Lim’s case was fairly similar to Yow Mee Lan’s. Long marriage, a matrimonial flat, a small business (or so we thought), a retail shop. Mrs Lim helped her husband with running the shop but common in a family run business, did not get a fixed salary. At the divorce, Husband claimed business was worth nothing and there was therefore nothing for her.

In 2001, the case came back to Ong Tay & Partners and we started an action for delivering of accounts as Mrs Lim was a director in the company. That was when we got Yew Fai to help us decipher the expert reports from Mr Lim’s accountant and to see how much the husband had pilfered from the business. Thanks to our forensic expert, we found that Mr. Lim’s own accountant’s reports actually confirmed that S$2m was expended without much basis. Mr. Lim’s accountant said that the S$2m was Mr. Lim’s business expenditure. Our legal-accounting team led by our then partner, Ying Ping, devised a series of cross questions and at the stand, Mr. Lim told the judge how he was really a frugal person and that he entertained his friends and clients only at hawker centres. This was what the judge told Mr. Lim: “You know, Mr Lim, I have some difficulty accepting your evidence here. Your own accountant has confirmed that you expended S$2m in business expenses yet you say you only entertained your clients and friends at hawker centres. S$2m is many plates of char kway teow and Coca-Cola, you know?”

For that case, the judge awarded Mrs. Lim about S$700,000.00 and that was just from the retail business.

When to Engage Forensic Accountants

Businesses

Since then, we try to include forensic accountants as part of our team whenever we have matrimonial estates comprising businesses. When a case goes to High Court, (the value of the estate now is S$5m for cases to be transferred to the High Court) invariably the matrimonial estate is a fairly complex portfolio of real properties, shares, investments and businesses. And some of us really need accounting experts to make sense of the numbers for us and our clients.

Something To Hide

Apart from that, the one consistent factor for me to decide when to call the accountants in is when I think, the other party has something to hide.

Most of us will know when that is, I believe. The clear cut cases are those when they don’t reveal what they have (you find out because your clients have already done their own investigations or from the basic due diligence like company searches).

The clever cases are the ones where they give you some documents design to mislead, like yes, I am a shareholder but I only hold 10% but actually when you dig deeper, you discover that 90% of his shares were transferred just at the time when parties separated.

So I call the accountants in as soon as I smell a rat. Even when there were not many documents, with the accountants’ help, I’d know what to ask for in my discovery applications.

Costs

Now as a small firm, one of the factors we often worry about is costs. Many of us here may think that forensic accountants are expensive and I have seen some fantastic bills when they did pretty much what the accountants here can do but charge like 10 times more. These firms are usually big, international ones that are also swallowing law firms.

But thanks to accountants from smaller, nimbler outfits, we are able to tap on each other’s expertise at a very affordable, easy entry level. Like for Yew Fai and his team here, they are prepared to meet with law firms for the 1st session and then charge something very reasonable for a preliminary investigation. The preliminary investigation is the stage where you already have some basic due diligence done (like company, title searches and have some company or bank records in hand). At this stage, they will let you know whether what is possibly the size of the estate, the low hanging fruits like liquid funds and further documents we should ask for or further investigations we ourselves can try to do or where they can help us.

Value For Me

For me, the value of having the accountants to help me with a case is their advice on how far we should go with discovery and then how much more we should advise the client to investigate. Sometimes, after a certain stage, it may mean spending a lot more for possibly not very much. And almost always, I will listen to the accountants’ counsel on when to stop. Very importantly, with their input, I will have the ability to advise the client when it is to accept a reasonable offer to settle or if we should fight on.

Conclusion

I will like to end my segment with this observation. With the increasing sophistication of our clientele, we must expect matrimonial estate to be more complex than before. It is no longer fair to clients that they accept our limitations as lawyers when we tell them sorry, as lawyers, we don’t do numbers. We must either educate ourselves to be more conversant with the requirements of the cases or have someone who can do the work on our team.

Thank you.